Tax Support

Offer tax tools to support 1099 workers with tax estimating, automated savings, and write-offs.

Get workers the answers and support they need with Level’s suite of tax tools, without any engineering lift required from you.

Tax write-off tracker

Level gives workers the ability to automatically track and categorize relevant expenses into IRS write-off categories. When it comes time to file year-end taxes, Level generates a Schedule C and financial statements that make it easy to file your 1099 taxes and enter your write-offs.

Quarterly tax estimator

Most 1099 workers aren't aware that they should pay quarterly tax estimates. As a result, many incur large unexpected bills at the end of the year and IRS late penalties. Level's software reviews a worker's financial history and tax profile to estimate their yearly and quarterly tax obligations, preventing year-end scrambling and surprises.

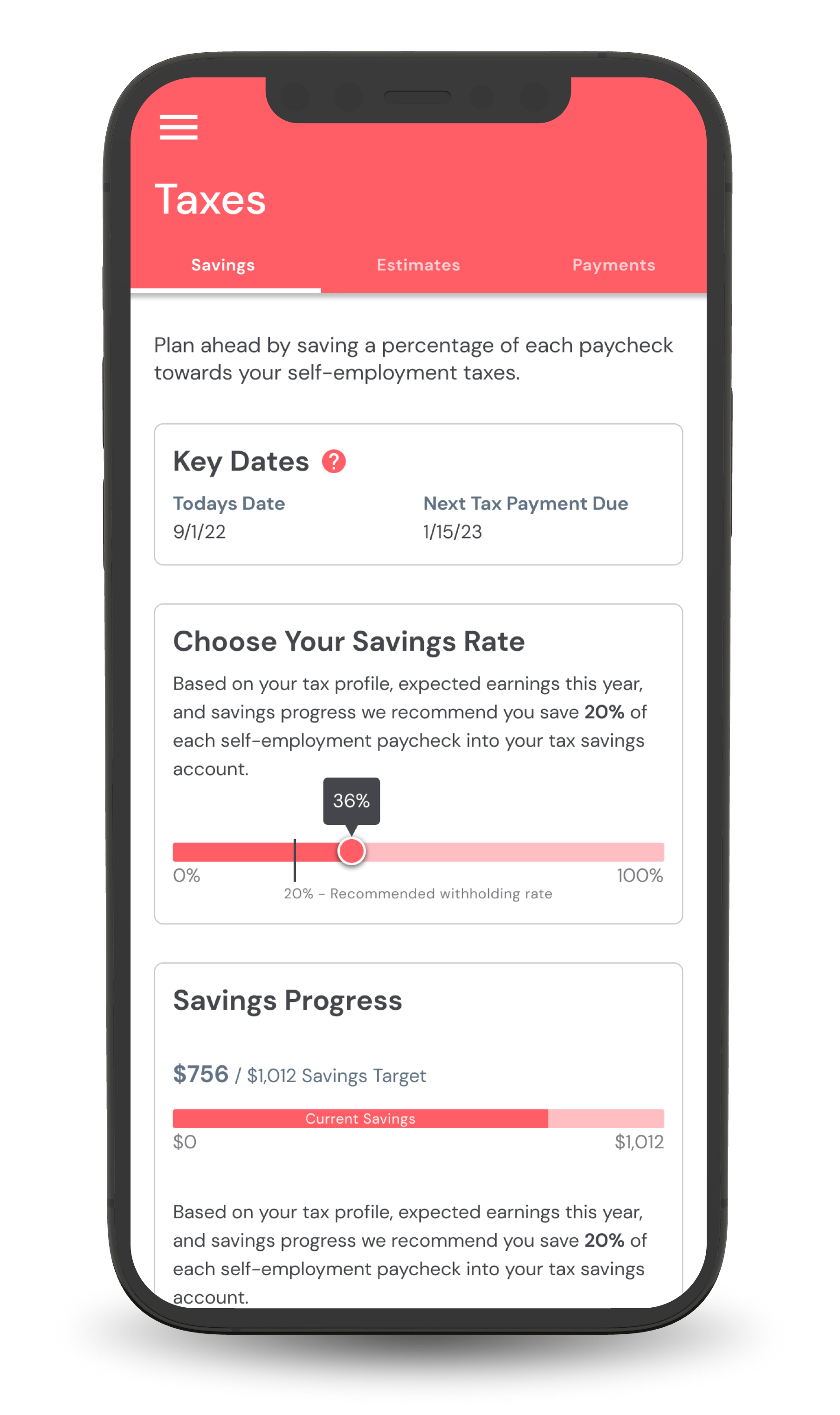

Automated tax savings

Level offers workers the option to "set and forget" tax savings by automatically sweeping a percentage of their 1099 earnings into a dedicated tax bucket account, which simplifies paying quarterly and year-end taxes.

Empower your platform’s independent workforce

Connect workers with the tax support they need at no cost to you.